Table of contents

You know that terrible, sinking feeling? You get it when you check your bank account. A huge chunk of money has simply vanished, leaving you wondering: Where did it all go? It’s rarely the big, expected bills that do the real damage. Instead, the problem lies in constant, tiny leaks. Think about little conveniences, impulse buys, and forgotten subscriptions. This pattern is frustrating. You feel like you should be doing better with your money. I call these zero-waste swaps because my goal is zero financial waste. It’s amazing how often saving money means reducing material waste, too!

I’m certainly not a financial guru, and this isn’t meant to be professional investment advice. This is just my personal diary of small, practical routines I’ve adopted over the past few years. It’s what’s finally helped me hold onto my money without feeling like I’m depriving myself.

My $5 Coffee I Finally Kicked: The 2-Minute Morning Hack That Saved Me $1,000!

For years, I told myself that my daily, drive-thru latte was my one small moment of peace. My reward for getting out of bed. But when I tracked it, I was spending close to $4.50 per cup, and when I looked at five days a week, that added up to nearly $90 a month—over $1,000 a year! Even cutting out just half of those daily stops makes a shocking difference. I felt a real sense of shame for complaining about money while buying that.

My swap wasn’t ‘stop drinking coffee’—that’s just unrealistic! Instead, I made it my new routine to make it better at home. I committed to using my own reusable mug and a simple setup.

Here’s the trick: I bought a $20 electric kettle and pre-set my flavorings the night before. I use a little reusable container for my coffee grounds and just add a pinch of cinnamon or a tiny dash of vanilla extract. In the morning, I just hit the switch.

This works because it’s about friction, not deprivation. Preparing ahead removes the stressful decision-making friction that usually drives me to the drive-thru window. It’s quicker than waiting in line, and I get to choose the exact temperature I like. I found that I save about $80 a month, which I immediately redirect into my ‘future spa day’ fund. That money wasn’t growing before, but now it is.

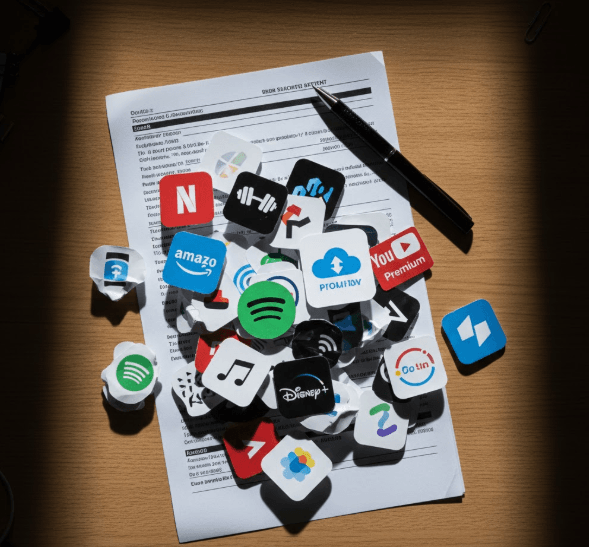

The Quiet $50 That Was Vanishing: How I Found and Cut the Hidden Fees?

Oh, the subscription shame! If you’re like me, you probably have at least one or two (or five) things you’re paying for monthly that you haven’t used in months. I was still shelling out for that “premium” fitness app I never used, a language app I used for one week, and a streaming service I never watched because my kids took over the TV. I was wasting money so passively!

My solution was simple but painful: a Subscription Audit Ritual. On the first of every month, I sit down—no excuses—with my credit card statement open. I look for any recurring charge that isn’t absolutely necessary.

My neighbor, who works in accounting, once told me that businesses are counting on us to be busy and forgetful; they call these “ghost costs” because they’re designed to blend into your monthly budget and vanish quietly. That simple awareness is half the battle.

To really enforce this swap, I canceled the old credit card where I had most of these saved and told my bank I lost it. It felt drastic, but the friction of having to manually re-enter a new card number made me think twice before signing up for the next “free” trial.

I have to be honest, I did accidentally cancel my husband’s favorite golf magazine subscription during one of my audits, which led to a week of silent treatment. Now, I use a physical notepad to list them before hitting cancel. I learned that being organized saves money, but being honest about all your family’s recurring expenses saves marriages!

The ‘Don’t Buy’ Challenge I Tried to Cure My Supermarket Shame

I’m a classic emotional spender when I’m tired, especially at the supermarket. I go in for basic necessities like milk and eggs, and somehow leave with a $15 fancy cheese board, a new scented candle, and a package of high-end cookies I didn’t need.

My Zero-Waste Grocery Swap was adopting a modified version of the “Don’t Buy” challenge, but just for the categories that hurt me most: ‘Convenience’ and ‘Aspirational’ foods. I now have a rule: I can buy any ingredient—produce, meat, pantry staples—but I can’t buy ready-made food (pre-cut fruit, expensive dips, pre-packaged desserts) or things I feel pressured to buy (that $5 water bottle by the checkout).

Why is this so effective? It’s not about being cheap; it’s about being intentional. Even when I’ve had very little to spare, I realized paying for convenience (like pre-cut fruit or those tempting checkout snacks) was always costing me more than paying for the whole ingredient itself. Cooking at home is nearly always cheaper, whether you’re saving $1 or $100.

To make this practical, if you’re shopping where a bulk section is available, bring your own containers for things like nuts, seeds, and even spices. It reduces waste, and you only buy exactly what you need, cutting down on food waste (and the money you spend on unused groceries).

I also started keeping a running list of “failed impulse buys” on my phone—the expensive thing I bought and then regretted. Just seeing that list stops me in my tracks sometimes.

See the Amazing Change When You Plug Up Your Wallet’s Tiny Leaks!

These aren’t complicated budget plans or intensive financial strategies. They are simply small, practical changes to my daily routine that swap a wasteful habit for an intentional one. We don’t need to stop spending completely—we need to spend with purpose. By redirecting that quietly vanishing money, you transform what felt like a frustrating loss into a growing opportunity, whether it’s for a small emergency fund or your next big vacation. Start small. You’ll be surprised how quickly those little leaks plug up!

(Disclaimer: This article is based purely on the author’s personal experience and routines and should not be taken as medical, legal, or financial professional advice.)

1 thought on “The 10 Quickest Zero Waste Swaps to Stop Wasting Money”