Ever gone for a routine eye exam, handed over your vision card, and then gotten slammed with a surprise bill for a test you thought was covered? It’s frustrating, to say the least.

But here’s the scary part: when it comes to glaucoma, a silent disease that can cause permanent blindness, that billing confusion is the last thing you need. Here’s the thing most people don’t realize: glaucoma screening isn’t a simple vision issue. It’s a medical one.

Of course, only a specialist can give you a real diagnosis, but understanding how to pay for the screening is the first critical step to protecting your sight.

The Silent Thief and Why You Can’t Wait

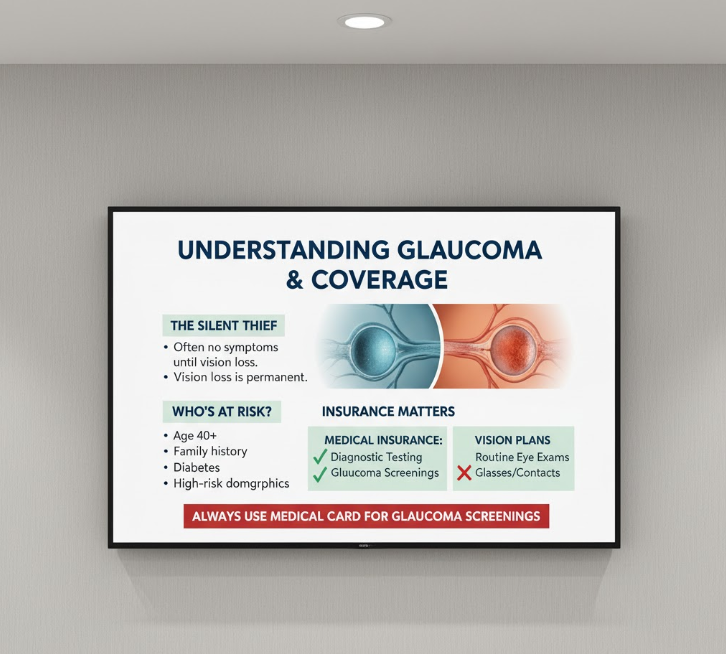

Glaucoma is tricky. It often has zero symptoms until it’s already stolen part of your vision—and that vision loss is permanent. This isn’t about just needing new glasses; it’s about irreversible damage to your optic nerve.

Most experts recommend getting a baseline screening around age 40. But if you have specific risk factors? That changes everything. I’m talking about having a family history of glaucoma, having diabetes, or being in certain high-risk demographics. If that sounds like you, an annual screening isn’t just a “nice-to-have.” It’s essential.

The Big Mistake: Handing Over the Wrong Card

Okay, so here’s the thing. When you book that screening, what card do you instinctively grab? Your vision plan, right?

Nope. Wrong card.

Vision plans are for routine wellness stuff—new glasses prescriptions, contact lens fittings, that sort of thing. But glaucoma testing? That’s a medical diagnostic test. You’re screening for a specific disease.

So it goes through your regular medical insurance, not vision. Hand them the wrong card and you’re basically asking for a denial letter. Treat this like seeing a specialist, not just getting your eyes checked.

Your 15-Minute Call to Save Hundreds

Look, don’t just show up and hope for the best. One quick phone call to your medical insurance before the appointment can save you hundreds in surprise bills.

I know, it’s annoying. But honestly, 15 minutes now beats a $300 shock later.

Here’s what you actually need to ask—not just “Am I covered?” Start with whether your doctor is in-network for this specific screening. Then confirm your plan covers glaucoma testing, especially if you’ve got risk factors like family history or diabetes. Some plans need pre-authorization too, so check that. And finally, nail down your actual out-of-pocket cost—the co-pay or co-insurance you’ll owe.

Oh, and when that “Explanation of Benefits” shows up in the mail a few weeks later? Actually open it. That’s your final receipt showing what they paid and what you owe.

It’s Your Call—And Your Vision

I know it feels like a lot of hoops to jump through just for an eye test. But that confusion over billing shouldn’t be the reason you put off a test that could literally save your eyesight.

If any of this sounds familiar, or if you know you’re in that high-risk group, it might be worth making that call. Ultimately, your judgment is what matters most. Don’t let a simple (and fixable) insurance mix-up stand in the way.